Beware of Credit Repair

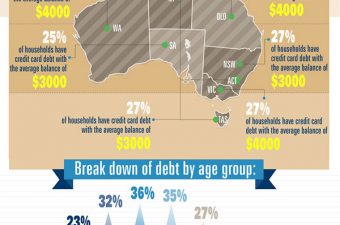

Due to Australia’s rising levels of personal debt, it has become increasingly common to see companies offering credit repair services. With an estimated one in seven Australians having a default on their credit report the demand for credit repair services is greater than ever. Many of these companies offer the promise of clearing your credit report and improving your credit score in exchange for a service fee of sometimes thousands of dollars or more. However on closer inspection the services offered by credit repair companies are often simple actions that can be done for free or cannot be done at all.

To understand what is being offered by credit repair agencies you must first understand the credit reporting system in this country. In Australia lenders base a potential borrower’s credit worthiness on the information listed on the borrower’s credit report. This report is a listing of all of your recent credit history, including loan applications, defaults and information on your current loans. Based upon this information credit reporting agencies assign you a credit score. Your credit score can determine whether banks and financial institutions will lend to you all forms of credit from mortgages to mobile phone plans. As a result of this, a negative listing on your credit report, such as a default, can be the difference between being approved for finance or not.

So what can credit repair agencies do to improve your credit score? The answer is: not much. A listing can only be removed from your credit report if it is wrong or placed on the report incorrectly. For example if you had failed to repay a mobile phone debt and the phone company had placed a listing on your credit report stating that you were in default on this debt, this listing cannot be removed.

However sometime listings are placed on people’s credit reports incorrectly or contain incorrect information. If you find that this has happened to you and have evidence to prove the listing is incorrect you can contact the relevant industry ombudsman and lodge a complaint which they will investigate for free. For complaints about banking or financial services listings contact Financial Ombudsman Service (FOS) or the Credit and Investment Ombudsman (CIO) for phone company listings the Telecommunications Industry Ombudsman (TIO) and for utilities state-specific energy and water ombudsmen. So even when a credit repair company helps you remove a listing from your credit report they are charging you for a service which could have been provided for free.

Credit repair agencies may play upon a customers’ lack of knowledge about credit reporting in order to make money. Often even if there is very little evidence to support a challenge to a listing on the customer’s credit report, some credit reporting agencies may lodge spurious or falsified claims in an attempt to get the listing removed. This includes falsely claiming that the borrower is in hardship or that a loan had been provided in breach of responsible lending obligations. These false claims will come to the attention of the Ombudsman and are viewed in a negative light, as well as diverting resources away from people with more legitimate claims.

While people are always looking for the quick-fix solution, ultimately the only way to improve your credit score is to develop better financial habits. For example set up direct debits on all of your utility bills, prepare weekly budgets for all of your expenses and stop using credit cards to pay for things you cannot afford. Only through these methods will you truly be able to repair your credit history and have a healthier financial future.

Fox Symes is the largest provider of debt solutions to individuals and businesses in Australia. Fox Symes helps over 100,000 Australians each year resolve their debt and take financial control.

If you are in debt and want to know more about the solutions available to you contact us on 1300 361 204.

Client Testimonials

What do customers think about Fox Symes? Hear what other customers are saying about us.