What is a Part 9 debt agreement?

A Debt Agreement is a legally binding arrangement between you and your creditors to repay your debts. Under a Debt Agreement you agree to repay an amount to your creditors over a set period of time, up to 3 or 5 years. This repayment amount is based on what you can reasonable afford to pay and has to be agreed upon by your creditors. Debt agreements are administrated in accordance with Part IX of the Bankruptcy Act 1966 and are sometimes referred to as Part 9 Debt Agreements.

In order to be eligible for a debt agreement you must:

- Be insolvent

- Have not been bankrupt, entered into a Debt Agreement or given an authority under Part X of the Bankruptcy Act in the last 10 years

- Be under set limits specified by AFSA for unsecured debts, assets and after tax income for the next 12 months

What does insolvent mean?

A debtor is considered insolvent if they cannot afford to repay their debt as and when they fall due.

Is it the same as going bankrupt?

No, although debt agreements are administrated in accordance with the Bankruptcy Act they are an alternative to bankruptcy. However, by submitting a proposal you are committing "an act of bankruptcy".

What affect does a debt agreement have on my debts?

Upon entering into your debt agreement your unsecured debts are frozen. This means that no interest or charges can be applied to your unsecured debts whilst the debt agreement is in effect. This allows you to repay your debts over a specified term, up to 3 or 5 years, via weekly repayments based upon affordability. After successfully completing the terms of the debt agreement you will be released from all unsecured debts included in the agreement.

How does it work?

Information

If you are eligible to submit a proposal then Fox Symes will help you with your paperwork and provide you with relevant information and documents you need to read and sign. We will need your help because you will have to provide us with information and documents. We will tell you what we need and this will include copies of your current payslips, Bank Statements, Proof of Rent or Mortgage Payments etc.

Paperwork

Once your paperwork has been finalised, you must read it, sign it and send it back to Fox Symes. We will then submit it to AFSA (see below). Your paperwork must be submitted to AFSA within 14 days of you signing and dating the proposal and Statement of Affairs.

Proposal Lodgement

AFSA will process your proposal after they have assessed it, checked your eligibility and determined that all the documentation is complete. AFSA writes to your creditors advising you have submitted a Debt Agreement Proposal and provides them with a copy of your proposal and Explanatory Statement.

What debts can I include in a debt agreement?

Only provable unsecured debts such as medical bills, store cards, credit cards and some personal loans can be included.

What happens to my secured debts such as my car loan and my house mortgage?

You must continue to pay these loans directly to your creditors.

Can I include my fines in the debt agreement?

Generally, fines are not a provable debt. This means you will have to continue to pay them outside of your agreement.

I have joint debt. What happens with it?

Your joint debt or debts must be included in your Debt Agreement. However, the co-borrower continues to be liable for the whole of the debt.

I have a debt which is guaranteed by someone else. What happens with it?

This debt must be included in your Debt Agreement. However, the guarantor will not be released from the debt and when you stop paying the creditor then they are likely to pursue the person under the guarantee.

Who is AFSA and what do they do?

Who is AFSA?

AFSA stands for Australian Financial Security Authority. It is the Federal Government agency responsible for the administration and regulation of the personal insolvency system in Australia.

Does AFSA have to accept my proposal?

There are eligibility requirements that must be satisfied in order for the debt agreement proposal to be accepted. Upon lodging your proposal with AFSA, the Official Receiver will assess the proposal and see if it satisfies these requirements. If the proposal is deemed not to meet these requirements or not to be in the best interest of the creditors, it may be rejected by AFSA.

How long does the process to take to complete?

Once the proposal has been processed, creditors are given 35 calendar days to vote on the proposal (42 days if the proposal in processed in December). During this period your creditors will be vote either accept or reject the proposal. The final day of this voting period is known as the deadline date.

What are the relevant dates during the voting period?

The first relevant date is the processing date, this is the date at which AFSA accepts your debt agreement for processing and sends it out to creditors to be voted on. 35 days from this date, or 42 if the debt agreement proposal is processed in December, is the final date for voting. This date is known as the deadline date.

Should I continue to pay my creditors during the processing period?

You may continue to pay your creditors during the processing period, the debt amount included in the debt agreement will be the amount owing on the deadline date. However, you should continue to pay your secured creditors the whole time as these are not included in the debt agreement.

What do the Creditors have to do?

The creditors are written to by AFSA and asked to vote to either support or reject your Debt Agreement Proposal. They are also asked to provide the amount outstanding on your account, advise if the account is secured or unsecured, if your account is joint or has a guarantor on it, or if you have any other debts with that creditor.

Do all my creditors have the right to vote?

All unsecured creditors have the right to vote. A secured creditor can only vote on any unsecured part of their debt. For example, if you have a secured car loan for which you owe $24,500 and your car is valued at $19,000 then the secured creditor has the right to vote on the unsecured portion of this debt. In this example, it is $5,500. This is because the value of your car is less than the amount you owe and that portion, or shortfall, is deemed to be an unsecured debt.

Do all creditors have to agree to my proposal?

No, not all creditors have to agree. The majority in value, i.e., 50.01% of the dollar amount of those creditors who decide to vote, and are entitled to vote, have to agree to your proposal. If you fail to disclose all of your debts or fail to advise that debt is a joint debt, has a guarantor, is secured/unsecured, or even just fail to disclose the correct debt level, these are just some reasons that may prompt the creditor to reject your proposal. You need to remember that your creditors may have access to information which you may not have disclosed to us.

What if a creditor does not vote or decides to vote against my proposal?

As long as the majority in value, i.e., 50.01% of the dollar amount of those creditors who decide to vote, and are entitled to vote, accept the proposal then it is legally binding on all creditors.

Can you guarantee that my creditors will accept my proposal?

No. It is your creditors who decide whether to accept or reject your proposal. However, as a debtor your responsibility is to make full and complete disclosure of your financial position to your creditors; put forward your best offer and commit to complying with the terms of the proposal.

What happens if the debt agreement is accepted by my creditors?

Once a debt agreement has been accepted by your creditors it becomes a legally binding arrangement. You must begin making the repayments set out in the agreement from which your creditors will receive dividends. While the agreement is in force the interest on your unsecured debts is frozen and no enforcement action can be taken against you or your property. Upon completing the terms of your debt agreement you will be released from all unsecured debts included in the agreement.

What happens if my creditors reject my proposal?

If your creditors vote to reject your debt agreement you may be able to resubmit another proposal. Resubmission will depend on the reasons for the proposal being rejected and whether an alternative agreement can be reached with your creditors. However once the proposal has been rejected the debts are revived and your creditors can resume their collection activity against you. If no suitable arrangement can be reached with your creditors you will need to consider alternatives such as bankruptcy.

What do I have to do?

Provide Information

You need to provide the information we request and make sure it is accurate and current. We also expect you to be truthful and disclose all information relevant to your situation.

Read and Sign Paperwork

To propose a Debt Agreement, you will need to read and sign several documents and return them to Fox Symes. These are legally binding documents, and as such there are penalties under the Bankruptcy Act and Criminal Code for providing false or misleading information. You should carefully and thoroughly read all the information we provide so you are fully informed.

Should I continue to talk with my creditors?

Yes. Your relationship with your creditors is important and by talking with them you can explain your situation and ask them to support your Debt Agreement Proposal. You may also forward their contact details to us and we will talk with them on your behalf.

What should I do if my circumstances change?

You need to inform us if your circumstances change at any stage during the process.

What are the consequences of a debt agreement?

Act of Bankruptcy

A debtor who proposes a Debt Agreement commits an act of Bankruptcy. This is not the same as going Bankrupt. A Debt Agreement is an alternative to Bankruptcy, but as it comes under Part IX of the Bankruptcy Act, proposing a Debt Agreement is considered an act of Bankruptcy.

NPII

Both the Debt Agreement Proposal and the Debt Agreement are registered on the National Personal Insolvency Index (NPII).

Credit Report

Veda Advantage and Dunn and Bradstreet and other credit-reporting bureaus can use the information on the NPII to advise any creditors that you are a party to a Debt Agreement. A creditor, prior to acceptance can register a default against your name with one of both of the credit report agencies. Your Debt Agreement will remain on your credit file for 5 years from the date it was entered and may affect your ability to get credit during this period.

What are the benefits of a debt agreement?

Greater control over your finances

If your creditors accept your Debt Agreement Proposal then for the term of your agreement you will know exactly how much you have to pay each week or fortnight or month toward it. This will allow you to budget and plan your finances. You also pay no interest on your Debt Agreement once it has been creditor accepted and there are no late or penalties fees.

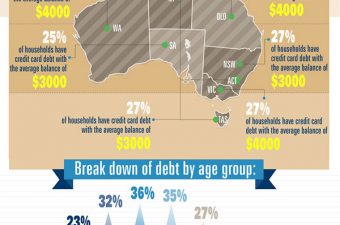

An end to your unsecured debt

If you complete your Debt Agreement, that is paid it off, then at the end of the term, you will be free from most of your unsecured debt, which is toxic debt. Compare how this works with continuing to make payments on your credit cards. You, like many people, may only manage to pay the minimum monthly repayment on your credit cards. By doing so you will find that it takes years to pay off your debt. Have a look at the moneysmart website (moneysmart.gov.au). It shows how $1,000 on your credit card can turn into an 11-year loan because the amount you owe will go down slowly and you'll pay a large amount of interest.

Financial discipline – the foundation for wealth creation

When you are in a Debt Agreement you have no access to credit and therefore you have to learn to live on what you earn. The reason most people get into debt is that they spend more than they earn. Credit is not your money – it is money you have borrowed and have to pay back. Not spending more than you earn is the foundation of financial discipline which can lead to wealth creation. If you apply financial discipline and complete your Debt Agreement then you can apply the same discipline to creating wealth.

What will I have to pay?

Set Up Fee

A set-up fee is charged for putting the Debt Agreement Proposal together and the work that is involved in doing so. This fee is $2,650. However, the maximum you will have to pay upfront is $850. The balance of $1,800 will be paid through the Debt Agreement and will receive the same rate of return as all other creditors. This fee is not refundable if creditors reject your Debt Agreement Proposal or if you withdraw it after it has been processed by AFSA.

AFSA Lodgement Fee

AFSA charges a Lodgement Fee for every Debt Agreement Proposal. This is a set amount of $200 and is payable every time a Proposal is lodged. This fee is not refundable and must be paid in full, in all circumstances. We will pay this expense on your behalf and recover it together with your Set Up Fee.

Administration Fee

An Administration Fee is charged by Fox Symes for administering your Debt Agreement over the term of your agreement. By law, these fees must be expressed both as a dollar amount and as a percentage of the payments to be made by you once the Debt Agreement Proposal is accepted. Let's look at an example of how this works.

Say for example you have unsecured debts totalling $35,000 and you can afford to offer your creditors $125 a week for 260 weeks which is $32,500. If creditors accept your proposals then they also appoint us to administer your Debt Agreement and in doing so they agree to allow us to retain a portion of what your payback for the work of administering the agreement. The amount we retain is taken from the $32,500 and it is not an additional amount or fee paid by you.

Realisations Charge

This is a levy charged by AFSA to fund the cost of conducting enquiries, investigating alleged offence, monitoring and regulating trustees and administrators and providing information to a range of clients. This fee is only charged when and if your Debt Agreement Proposal is accepted by your creditors. It is currently charged at 7% of the money received by the administrator of your Debt Agreement, and as with the Administration Fee (see above); this amount is calculated based on the amount of money being paid in your Proposal.

If creditors reject my Debt Agreement Proposal do I get a refund?

No. If Creditors reject your Debt Agreement Proposal your Set Up Fee will not be refunded. If AFSA rejects your proposal for processing because you did not include material information your AFSA Lodgement Fee will not be refunded and nor will your Set Up Fee. Should AFSA reject your proposal for processing because of a Fox Symes error then, in that instance only, your Set Up Fee will be refunded. Please refer to the Appointment and Agreement form.

What happens now?

That is entirely up to you. If you wish to proceed with submitting a Debt Agreement Proposal then you will need to work together with your consultant to obtain all of the information needed to proceed. If you are still not sure then you are still able to contact your consultant to discuss this further. If you would like some further information, here are some websites that may be able to help.

If you are in debt and want to know more about the solutions available to you contact us on 1300 361 204.

Client Testimonials

What do customers think about Fox Symes? Hear what other customers are saying about us.